Wealth: Five Formulas and a Recipe

A Blueprint for Flourishing.

I asked my friends and readers for the best things they’ve read on how to get wealthy and stay wealthy.

I was overwhelmingly sent the same small handful of articles, and there was a lot of thematic overlap between each of them.

Here are five recurring formulas and an individual story that ties it all together beautifully.

1. Ownership > Salary

- “You’re not going to get rich renting out your time. You must own equity - a piece of a business - to gain your financial freedom.” (Naval Ravikant, How to Get Rich (without getting lucky)).

- “The biggest economic misunderstanding of my childhood was that people got rich from high salaries. Though there are some exceptions—entertainers for example —almost no one in the history of the Forbes list has gotten there with a salary. You get truly rich by owning things that increase rapidly in value.” (Sam Altman, How to Be Successful).

- “If you wanted to get rich, how would you do it? I think your best bet would be to start or join a startup. That's been a reliable way to get rich for hundreds of years.. [As of the 2020 Forbes list] “How are people making these new fortunes? Roughly 3/4 by starting companies and 1/4 by investing.” (Paul Graham, How to Make Wealth and How People Get Rich Now).

2. Ownership + “Leverage” = Wealth

- “To get rich you need to get yourself in a situation with two things, measurement and leverage. You need to be in a position where your performance can be measured, or there is no way to get paid more by doing more. And you have to have leverage, in the sense that the decisions you make have a big effect.” (Paul Graham, How to Make Wealth).

- “Fortunes require leverage. Business leverage comes from capital, people, and products with no marginal cost of replication (code and media).” (Naval Ravikant, How to Get Rich (without getting lucky)).

3. Passion + Curiosity = Durability

- “You will get rich by giving society what it wants but does not yet know how to get. At scale… Specific knowledge is found by pursuing your genuine curiosity and passion rather than whatever is hot right now. Building specific knowledge will feel like play to you but will look like work to others.” (Naval Ravikant, How to Get Rich (without getting lucky)).

- “Eventually, you will define your success by performing excellent work in areas that are important to you. The sooner you can start off in that direction, the further you will be able to go. It is hard to be wildly successful at anything you aren’t obsessed with.” (Sam Altman, How to Be Successful).

4. Durability + Time = Compounding

- “All compounding is never intuitive. And that’s why, if we look at someone like Buffett, we in the financial industry have spent so much time trying to answer the question: how has he done it? And we go into all this detail about how he thinks about moats and business models and market cycles and valuations, which are all important topics. But we know that literally 99% of the answer to the question, how has he accumulated this much wealth, is just that he’s been a good investor for 80 years. It’s just the time. And if Buffett had retired at age 60, like a normal person might, no one would’ve ever heard of him. He would’ve been like one of hundreds of people who retired with a couple hundred million bucks and like moved to Florida to play golf… 97% of his wealth came after his 65th birthday.” (Morgan Housel on Tim Ferriss’ podcast)

5. Defining Wealth > Having Wealth

- “The best measure of wealth is what you have minus what you want.” (Morgan Housel, Some Things I Think).

- “Rich means you have cash to buy stuff. Wealth means you have unspent savings and investments that provide some level of intangible and lasting pleasure – independence, autonomy, controlling your time, and doing what you want to do, when you want to do it, with whom you want to do it with, for as long as you want to do it for.” (Morgan Housel, The Rich and the Wealthy).

- "Wealth is the full set of transformations you are capable of carrying out." (David Deutsch on the Tim Ferriss podcast with Naval). [Essentially wealth measured as degrees of freedom and your effectiveness in the real world].

Summary and a Story

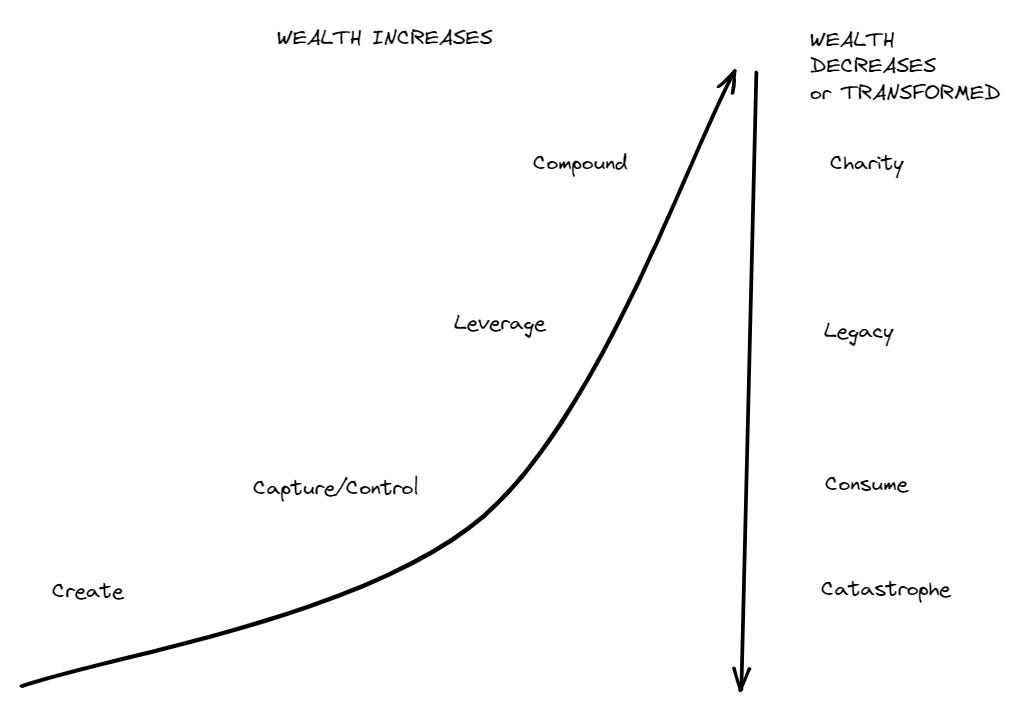

Frederik Gieschen recently summed up a lot of these insights with a simple framework and great chart:

A Simple Framework For The Drivers of Wealth

When pursuing wealth, ask yourself:

- How much economic value do I create?

- How much of this value do I capture? (Do you own/control your work or what is your relationship with the party who does?)

- How much leverage is being applied to my work? (Including capital, labor, technology/code, content/media, and networks)

- At what rate and for how long can I compound my capital?

About the capital you have already retained, ask yourself:

- How much of my capital do I consume?

- How much is exposed to the risk of catastrophic loss (bad decisions, bad luck, or ‘acts of god’)?

- How much am I returning to society?

- And what should happen to whatever is left?

Finally: The Ed Thorp Story.

David Senra of the Founders podcast has meticulously profiled over 220 of the world’s most successful and influential people. Ed Thorp is an American math professor, author, blackjack researcher and founder of one of the first quant hedge funds. David’s comments on Thorp are so fascinating to me they are worth quoting in full:

Out of every single person I have studied so far for the podcast, Ed Thorp is my personal blueprint. He is the single person.

If I only had to pick one of who do I want to most be like, who do I want to copy, who do I want to emulate, it's him. He is the person, in my opinion, that has come close to mastering life. Every single person that we study in the podcast has mastered their professional life. They're the best in the world, in many cases, or one of the best in the world at what they do. But the mistake a lot of them make, almost all of them make, is the fact that they overemphasize -- or over-optimize for their professional life at the detriment to everything else.

[Nassim Taleb wrote in the foreword to Thorp’s memoir: “You can detect that this man is in control of his life. This explains why he looked younger, the second time I saw him in 2016 than he did the first time in 2005.”]

And there's 5 main areas that I think Ed focused on:

- First is lifetime learning. He's largely self-taught, he's curious about the world around him, and he's constantly seeking -- up until this day, constantly seeking knowledge and information that will help him in life.

- The second thing, he's really rich, and he didn't start out that way. His parents were really poor. But the difference between Ed and most really, really rich people is he realized, like Ben Franklin realized before him, a couple of hundred years before Ed Thorp was even born, that time is the stuff that life is made of. And so Ed wouldn't chase more money at the expense of other areas in his life after he was already really wealthy and had more money than he could ever spend.

Number three, he took care of his health. He developed simple systems that we'll talk about today because that's part of his genius. That's what Taleb was just hinting at, the fact that he just developed simple systems for everything. One of the things he developed simple systems for is how to be healthy to be physically fit. So he took care of his health, he developed simple systems, and he made it a priority.

And he looks -- if you watch an interview, there's a bunch of interviews on YouTube of him, especially when this book was coming out a couple of years ago, he did a bunch of interviews to promote it, he looks 20 years younger. He's almost 90 years old. He's giving interviews. So I think he's 85 at the time. And if you look at this, he looks like he's in his mid-60s. He talks about what he figured out at a young age is like, “Every hour I spend exercising I thought of as one less day that I'll spend in the hospital at the end of my life”.

- Number four.. he had good relationships. He was a good father. He was a good husband. He made spending time with his family and friends a priority. He got the most joy out of his life from the times he spent with the people he loved. He talks a lot about this in the book.

- And number five, just like what Nassim was mentioning in the forward, he treated life like the adventure it is. He had fun. And part of the way he had fun was he actually followed his genuine intellectual curiosity. There is a great quote by Naval Ravikant, the Founder of AngelList. And he said that, "Following your genuine intellectual curiosity is a better foundation for a career than following whatever is making money right now”.

So there's just a ton to learn from him, but the 5 things that I think are interesting; he's smart, he's rich, he's physically fit, he's got good relationships, and he had fun.

[David’s full podcast episode on Ed Thorp is here].

Thanks for reading What's Important?! Subscribe for free to receive new posts and support my work.