Five Revealing Pictures

#1 will amaze you! (But really it might)

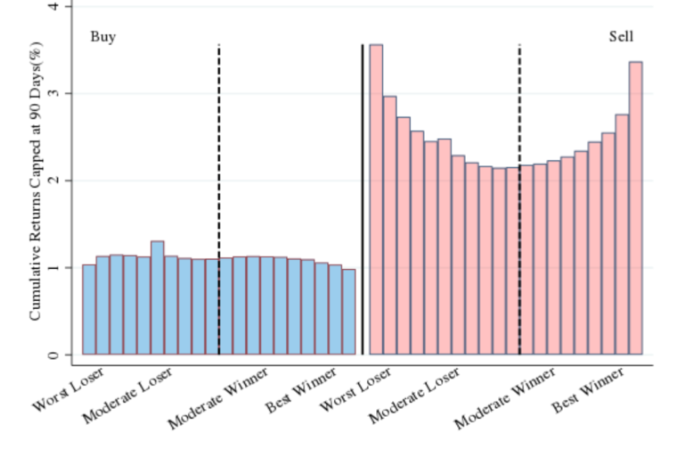

1. Sell slow!

One of my favourite finance studies analyzed a huge database of 4.4 million trades made by professional money managers over 16 years. The conclusion is remarkable and actionable: even professional investors sell stocks worse than randomly.

Professional money managers do well on their “slower”, buying decisions (actually well enough to beat benchmark portfolios!). It’s on their “faster”, selling decisions that money mangers significantly underperform. As you can see on the right, they tend to sell their big past winners or past losers at rates well above average. The takeaway is pretty wild: just throwing a dart at your portfolio and selling whatever it hits, could boost performance by ~1% a year, which is A LOT both in professional investing and over the long term.

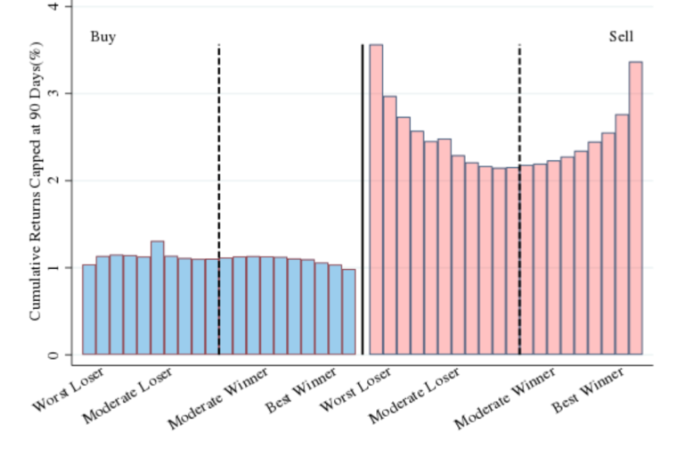

2. We are more alike than we are different.

YouGov asked “If you have to guess, which percentage of American adults are…”

The blue is how big respondents thought a group was, the red is how big it actually is. It’s quite a fun game to guess the size of a group, then also guess what the consensus thinks.

The results suggest we pay more attention to what makes us different than what makes us alike. My favourite counterintuitive insight on the culture wars is from Karen Stenner:

"All the available evidence indicates that exposure to difference, talking about difference, and applauding difference - the hallmarks of liberal democracy - are the surest ways to aggravate those who are innately intolerant, and to guarantee the increased expression of their predispositions in manifestly intolerant attitudes and behaviours. Paradoxically, then, it would seem that we can best limit intolerance of difference by parading, talking about, and applauding our sameness.”

We are all completely unique individuals, of equal humanity.

3. The shorter your time-horizon, the more people you’re playing against.

Given the unfathomable sophistication and resources of your opponents, trading short term can be like showing up blind drunk to a $1,000-a-hand poker table in Vegas.

But once you get into multiple decades, your only real opponent is your own bad behavior. Recall one of my favourite statistics: 97% of Warren Buffett’s net worth was accumulated after he turned 65.

4. The future is unevenly distributed.

Looking at the changes in prices for households over the last 22 years the differences are stark. It’s clear that technology has had a massive impact on prices for hardware (let alone the cost and breadth of entertainment media). But real-world goods like education, housing and healthcare have seen huge price increases. “Bits” are cheaper, “atoms” are much more expensive.

As of a few years ago, 88% of US inflation since 1990 originated in 4 sectors of the US economy: healthcare, higher education, real estate and prescription drugs.

5. Finally- “This Too Shall Pass”

In 1931, John B. Sparks created a timeline for 4,000 years of human history. You can see what a truly enduring empire looks like.

One of my favourite stats is that Cleopatra lived closer in time to the building of the first Pizza Hut than to the builders of the original pyramids.

Thanks for reading What's Important?! Subscribe for free to receive new posts and support my work.