Cash: Return of the King

Three timely thoughts on a timeless theme.

[4 minute read]

Cash Rules Everything Around Me

-Wu-Tang Clan

Sapient Capital’s founding partner Jeff Cohen recently highlighted a new report that was worthy of a quick examination. It helps illustrate three timeless and timely themes in Wealth Management.

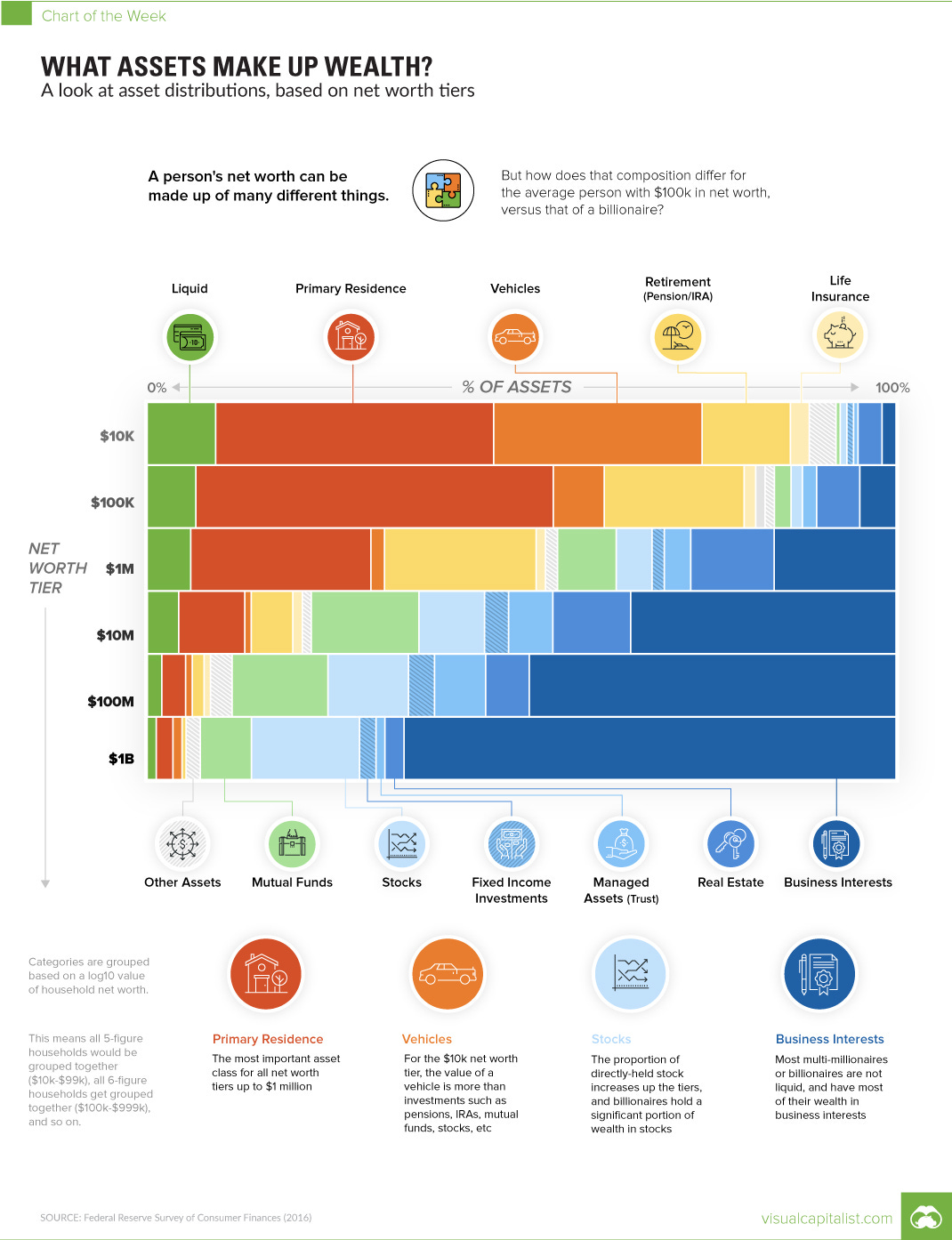

Most of the richest people in the U.S. have the vast majority of their wealth in a single asset. In fact, as you can see below, the wealthier people are, the more concentrated they tend to be in a single asset class. Often it’s in the single business that made them rich in the first place.

Once wealth has been made, focus inevitably switches to managing risk. Over the long term, concentrated positions can carry significant risk.

Morgan Stanley’s excellent Michael Mauboussin just published a report called Birth, Death, and Wealth Creation. Although he found that company survival rates have increased in the last 20 years, about half of all public companies since 1926 have delisted within 10 years of their listing. Moreover, he cites research that found:

Nearly 60% of companies that have been public in the U.S. over the last century or so have failed to create value, defined as earning total shareholder returns in excess of one-month Treasury bills.

This is supported by one of my all-time-favourite research reports, The Agony and the Ecstasy from JP Morgan Asset Management. For holders of concentrated positions, there seems to be a lot more agony than ecstasy. JPM found that from 1980 to 2020:

Around 40% of the time a concentrated position in a single stock experienced negative absolute returns, in which case it would have underperformed a simple position in cash.

It gets worse:

More than 40% of all companies that were ever in the Russell 3000 Index experienced a “catastrophic stock price loss”, which we define as a 70% decline in price from peak levels which is not recovered.

JPM had a helpful list of exogenous reasons why companies fail.1 In contrast, Mauboussin’s report references a Bessembinder study on the characteristics of top wealth-creating companies.2

But one variable seems to shine out among all others:

CASH.

It’s relevant to this piece in at least 3 specific ways:

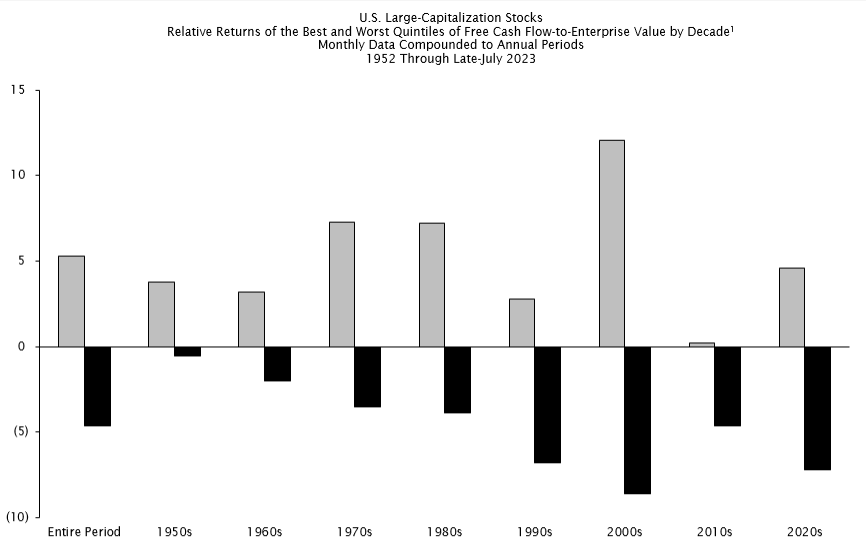

- For investors: Our friends at Empirical Research Partners have long stressed how free cash flow metrics have among the best performance of any other factor over the last 7 decades of data. They have also argued that this is now especially true over longer holding periods. Long term focus on free cash flow is a cornerstone of our own investment strategy at Sapient.

- For business owners: Cash is central to long-term resilience and longevity. The Long Now Foundation found that of 5,500 companies over 200 years old across 41 countries, 56% of them are in Japan, and most are small family businesses. What’s notable about these companies is that they typically maintain very high cash balances, often as much as two years’ worth. [I’m not sure what it says that, of the 1,000 companies that made it to over 300 years old, 23% are in the alcohol industry].

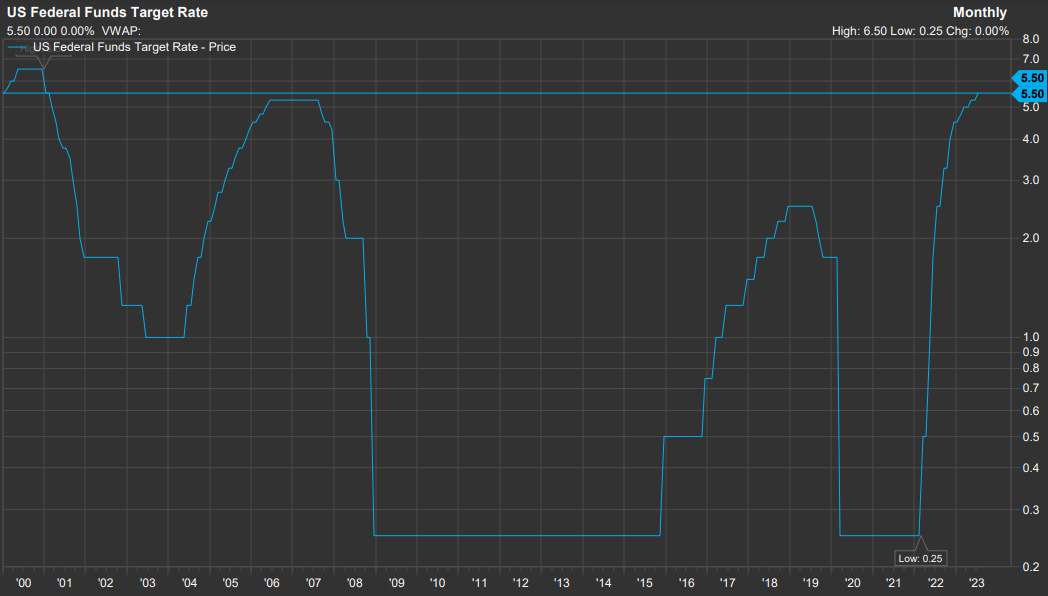

- For everyone: It’s happened so fast, with 11 hikes since last March, it’s easy to forget that interest rates are now at a 22 year high! The adage is that Americans are more likely to change their spouse than their bank account. According to Bankrate.com, the national average yield for savings accounts is still just 0.53%. For the first time in many peoples’ professional careers, cash is not just a hedge against business failure, it’s a source of returns.

Sapient’s cash sweep is the Dreyfus Money Market (DGVXX/DGMI) which is currently yielding 4.86%. and comes with daily liquidity. Other options include short term T-Bills which range from 5.35% to 5.46%.3

We have lots of cash equivalent and fixed income solutions here at Sapient, give your advisor a call to discuss.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

Sapient Capital is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Sapient Capital and its representatives are properly licensed or exempt from licensure.

J.P Morgan’s list of exogenous causes of business failure:

Commodity price risks that cannot be hedged away

Government policy: changes in service reimbursement rates, a slowdown in FDA approval patterns, bandwidth and other public domain privatizations which increase the scope of competition, changing subsidies for renewable energy, changes in carbon tax regimes and fracking rules, government-sponsored enterprises with a lower cost of funds crowding out private sector activity, changes in the interpretation of anti-trust rules, shifts from capacity pricing to merchant pricing (natural gas), and price caps on Medicare Part B and D drug prices that align them more closely with international levels

On government action, deregulation has proven to be just as disruptive as re-regulation, particularly as it relates to boom–bust cycles in telecommunications, utilities and broker-dealers

Foreign competitors whose market share is magnified by government subsidies and FX manipulation. China’s exchange rate management and subsidies to its auto, steel, solar, paper and glass companies are primary examples

Intellectual property infringement by domestic or foreign firms The impact of patent trolls, estimated to cost US businesses upwards of $20 billion per year

Changes in US or foreign government tariff or trade policy

Fraud by non-executive employees, which according to SEC investigations account for ~30% of all instances; or fraud by employees or management in companies that you acquire, or which acquire you

Technological innovation that effectively provides consumers with enough information to bypass intermediaries and distributors

A shift in buying power to the firms’ customers resulting from consolidation

Unconstrained expansion by competitors, leading to a collapse in pricing power ↩

Bessembinder’s characteristics of top wealth-creating companies.

As of 7/31/2023 ↩

Bessembinder’s characteristics of top wealth-creating companies.

As of 7/31/2023 ↩